Housing Tax Credits

Housing Tax Credits

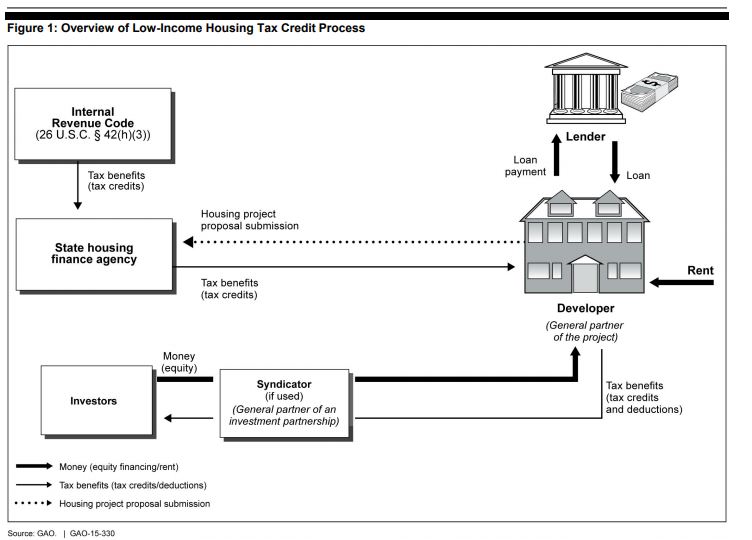

The federal government subsidizes affordable housing through numerous tax and spending programs, one program is the Low Income Housing Tax Credit (“LIHTC”). The program provides ~$9 billion a year in tax credits to support affordable housing construction. LIHTCs finance about 90% of all affordable housing production and preservation, and has been a critical subsidy for ensuring the stability of millions of low-income families.

The federal government distributes the credits to the states, which in turn award them to developers to cover part of the costs of constructing apartment buildings and other projects. In return, developers must cap rents for the units they set aside for low‐income tenants.

Companies

NOTEWORTHY MENTIONS

Pros and Cons of Low Income Housing Tax Credit System

- Pros: by Enterprise Community Partners

- Cons: by Cato Institute

NEXT

NEXT